FY23 Summary:

- A fully franked dividend of 4.0 cents per share for 2H23, bringing the total dividend for FY23 to 7.3 cents per share fully franked.

- Annual dividend yield of 6.3% and a grossed up dividend yield of 9.0% [1]

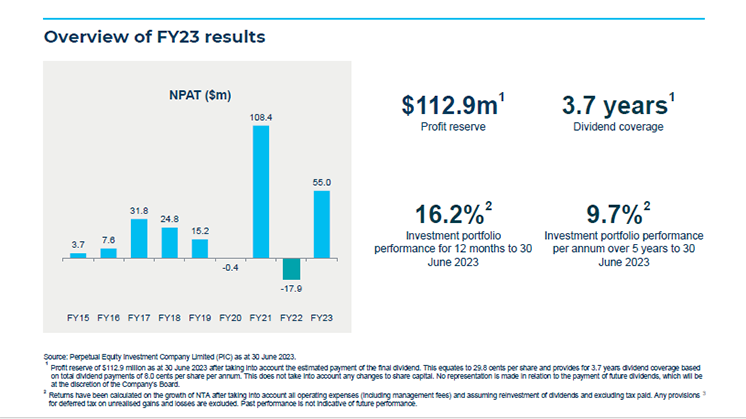

- Achieved strong net profit after tax outcome of $55 million, contributing to the Company’s profit reserve of $112.9 million and 3.7 years dividend coverage [2]

- Investment portfolio performance has outperformed benchmark over 1, 3, 5 and 7

PIC Chairman Nancy Fox said, “In a volatile and uncertain market environment, we are pleased to again provide shareholders with a consistent income stream through a strong dividend payment for FY23. The Board believes the total dividend payment for FY23, a record for the Company, translates to an attractive annual dividend yield of 6.3% and grossed up dividend yield of 9.0%.

“The dividend payment, along with the strong net profit of $55 million, reflects the skill of the Manager who again outperformed the market in FY23, generating profit and franking credits from positive investment performance, and dividends received from underlying companies, as well as the Board’s focus on effective capital management.

“The Company’s profit reserve is $112.9 million after the payment of the final dividend which provides for 3.7 years dividend coverage. In the current environment we believe the profit reserve strikes the right balance between returning capital to shareholders through an increased dividend, while at the same time retaining capital to deliver a sustainable long-term income stream for shareholders.”

“Over the next 12 months it’s likely we will continue to see choppy market conditions with inflation being the main driver of the macroeconomic environment. The Board is confident that the Manager’s active approach to investing shareholder capital, combined with the Company’s flexible investment strategy, will continue to provide a solid platform to seek out the best possible investment opportunities.”

PIC performance and market conditions

The Company’s investment objective is to provide shareholders with an income stream and long-term capital growth in excess of the benchmark over minimum 5year periods. This objective is underpinned by a proven, bottom-up investment process that focuses on value and quality.

Investment portfolio performance of 16.2%[3] for the 12 months to 30 June 2023 outperformed the benchmark by 1.8%. In line with the Company’s investment objective, the investment portfolio has returned 9.7% p.a.[3] over 5 years, outperforming the benchmark by 2.6%.

PIC Portfolio Manager Vince Pezzullo said: “The last 12 months has once again seen a number of macroeconomic factors create noise, uncertainty and volatility in the market, with reducing core inflation being the focus of many central banks. Furthermore, factors such as increased geopolitical tensions, de-globalisation and decarbonisation are additional pressures to what is already quite an unstable and uncertain broader economic and market outlook.

“As long-term active investors, this uncertainty creates opportunities in the market to buy quality companies with solid balance sheets and good prospects of providing long term returns with lower than market risk. Through these times, we remain focused on sensibly protecting and growing our shareholders capital.”

[1]Yield is calculated based on the total dividends of 7.3 cents per share and the closing share price of $1.165 as at 30 June 2023. Grossed up yield takes into account franking credits at a tax rate of 30%.

[2] Profit reserve of $112.9 million as at 30 June 2023 after taking into account the estimated payment of the final dividend. This equates to 29.8 cents per share and provides for 3.7 years dividend coverage based on a total dividend payment of 8.0 cents per share per annum. This does not take into account any changes to share capital. No representation is made in relation to the payment of future dividends, which will be at the discretion of the Company’s Board.

[3] The benchmark is the S&P/ASX 300 Accumulation Index. Returns have been calculated on the growth of NTA after taking into account all operating expenses (including management fees) and assuming reinvestment of dividends and excluding tax paid. Any provisions for deferred tax on unrealised gains and losses are excluded. Past performance is not indicative of future performance.