[1] Past payments of dividends is not indicative of future payments of dividends. The payment of dividends is at the discretion of the PIC board.

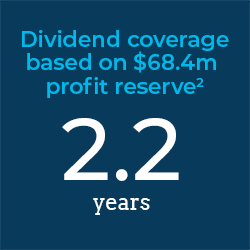

[2] Profit reserve of $68.4 million as at 31 December 2025 after taking into account the estimated payment of the interim dividend. This equates to 17.8 cents per share and represents 2.2 years dividend coverage assuming a total dividend payment of 8.0 cents per share per annum. This does not take into account any changes to share capital. No representation is made in relation to the payment of future dividends, which will be at the discretion of the Company’s Board.

[3] Yield is calculated based on the total dividends of 8.0 cents per share and the closing share price of $1.250 as at 31 December 2025. Grossed up yield takes into account franking credits at a tax rate of 30%. No representation is made about the payment of future dividends.

Disclaimer/important information

All investments carry risk, including loss of capital. This information was prepared by Perpetual Investment Management Limited (PIML) ABN 18 000 866 535, AFSL 234426. PIML is the manager for the Perpetual Equity Investment Company Limited (Company) (ASX: PIC) ACN 601 406 419. It is general information only and is not intended to provide you with financial advice. You should consider, with a financial adviser, whether the information is suitable for your circumstances. This information is in summary form and is not necessarily complete. It should be read together with other announcements for the Company lodged with the Australian Securities Exchange, which are available at www.asx.com.au. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information.

This information may contain information that is based on projected and/or estimated expectations, assumptions or outcomes. These forward-looking statements are subject to a range of risk factors. The Company and PIML caution against relying on any forward-looking statements, particularly due to uncertainty and volatility in the market and geo-political factors.

While PIML has prepared this information based on its current knowledge and understanding and in good faith, there are risks and uncertainties involved which could cause results to differ from the forward-looking statements. Neither the Company or PIML will be liable for the correctness and/or accuracy of the information, nor any differences between the information provided and actual outcomes, and reserves the right to change its projections or other forward-looking statements from time to time. Neither the Company nor PIML undertake to update any forward-looking statement to reflect events or circumstances after the date of this presentation, subject to disclosure obligations under the applicable law and ASX listing rules.

Neither the Company, PIML nor any company in the Perpetual Group guarantees the performance of, or any return on an investment made in, the Company. Perpetual Group means Perpetual Limited ABN 86 000 431 827 and its subsidiaries. Past performance is not indicative of future performance.