FY25 Summary:

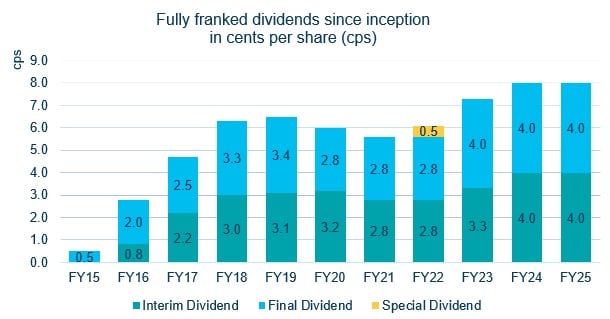

- A fully franked final dividend of 4.0 cents per share for 2H25, consistent with the 1H25 interim dividend, and both the interim and final dividend for FY24.

- A full year fully franked dividend of 8.0 cents per share for FY25, consistent with FY24. FY25 total dividend equates to a dividend yield of 6.6% and a grossed-up dividend yield of 9.4%.1

- 5-year investment performance of 12.1% p.a.2

- Net profit after tax of $21.7 million and the Company’s profit reserve of $67.8 million providing for 2.2 years dividend coverage after the payment of the final dividend.

Perpetual Equity Investment Company Limited (ASX:PIC; the Company) announces a net profit after tax of $21.7 million for FY25 and a fully franked 2H25 dividend of 4.0 cents per share, bringing the total dividend payment for PIC shareholders in FY25 to 8.0 cents per share, consistent with the previous financial year.

PIC Chairman Nancy Fox AM said, “We are pleased to deliver another strong dividend outcome for FY25, which at 8.0 cents per share is consistent with FY24 as the highest dividend payment since the Company’s inception, and delivers on the Company’s objective to provide an income stream for PIC shareholders. The full year fully franked dividend equates to an annual dividend yield of 6.6% and grossed up yield of 9.4%1. This compares favourably to the dividend yield of the S&P/ASX 300 Accumulation Index which was 3.2% as at 30 June 20254.

"Throughout the financial year we also surpassed 10 years since the Company’s inception on the ASX. Throughout that time, the Board has maintained its focus on the management of shareholder capital to ensure the overall position of the Company remains strong. This has allowed the Company to consistently deliver fully franked reliable income streams for our shareholders via dividend payments which translate to attractive yields.”

After the payment of the 2H25 dividend, the profit reserve for the Company sits at $67.8 million which provides 2.2 years dividend coverage3.

PIC performance and market conditions

For the 12 months to 30 June 2025, the PIC portfolio returned 6.5%2 whereas the S&P/ASX 300 Accumulation Index (benchmark) returned 13.7%.

“While relative investment performance for the PIC portfolio underperformed the benchmark in FY25, the Manager has a tried and tested approach to value investing that has been proven over many decades to protect and grow shareholder capital, and drive returns, over the medium to longer term.

“The appointment of Sean Roger as Co-Portfolio Manager for PIC, which we announced in March this year, further strengthens the team and we are confident Vince and Sean will continue to identify opportunities to generate returns for PIC shareholders”.

Portfolio Manager Vince Pezzullo said: “While acknowledging that, on the whole, markets have mostly seen positive gains throughout the financial year, we’re increasingly cautious around the extreme concentration and elevated valuations in certain defensive and quality sectors.

“Further, we’ve seen momentum continue to drive near-term share price outcomes in Australia, leading to wide dispersion beneath headline index returns. As a value investor, this dispersion is creating opportunities in businesses facing short-term uncertainty but with sound long-term fundamentals. We remain focused on identifying dislocations where price and value have diverged, and we believe our current portfolio is well positioned to benefit as the market adjusts.”

As at 30 June 2025 the portfolio held 74.4% in Australian listed securities, 19.7% in global listed securities and 5.9% in cash.

1 Yield is calculated based on the total dividends of 8.0 cents per share and the closing share price of $1.21 as at 30 June 2025. Grossed up yield takes into account franking credits at a tax rate of 30%.

2 The benchmark is the S&P/ASX 300 Accumulation Index. Returns have been calculated on the growth of Net Tangible Assets (NTA) after taking into account all operating expenses (including management fees) and assuming reinvestment of dividends and excluding tax paid. Any provisions for deferred tax on unrealised gains and losses are excluded. Past performance is not indicative of future performance. For details of the Company’s investment performance, please visit https://www.perpetualequity.com.au/tools-and-resources/research-reports

3 Profit reserve of $67.8 million as at 30 June 2025 after taking into account the estimated payment of the final dividend. This equates to 17.7 cents per share and represents 2.2 years dividend coverage assuming a total dividend payment of 8.0 cents per share per annum. This does not take into account any changes to share capital. No representation is made in relation to the payment of future dividends, which will be at the discretion of the Company’s Board.

4 Source: Factset.